‘ Harvard Growth Lab Latest Forecasts’ combined with

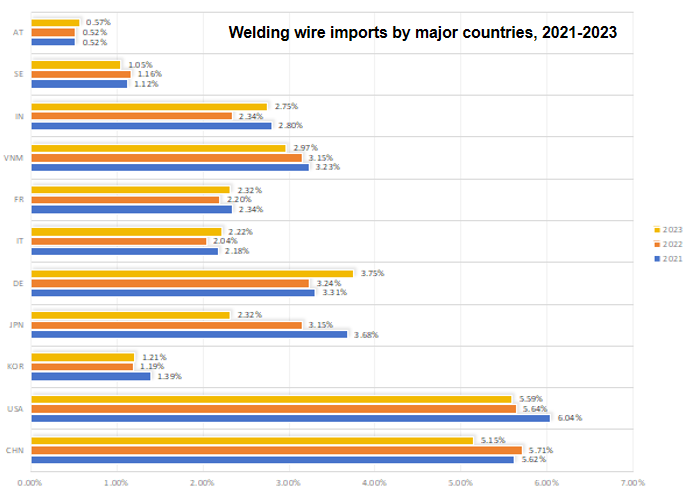

’Welding Wire Imports and Exports by Major Countries, 2021 to 2023’

China, India, Indonesia, Uganda, and Vietnam are projected to be among the fastest-growing economies for the coming decade, according to researchers at the Growth Lab at Harvard University. The new growth projections presented in The Atlas of Economic Complexity include the first detailed look at 2023 trade data, which reveal continued disruptions from the uneven economic recovery to the global pandemic. China is expected to be the fastest-growing economy per capita, although its growth rate is smaller than gains seen over the past decade.

Growth over the coming decade is projected to take off in three growth poles, East Asia, Eastern Europe, and East Africa. Several Asian economies already hold the necessary economic complexity to drive the fastest growth over the coming decade to 2031, led by China, Cambodia, Vietnam, Indonesia, Malaysia, and India. In East Africa, several economies are expected to experience rapid growth, though driven more by population growth than gains in economic complexity, which include Uganda, Tanzania, and Mozambique. Eastern Europe holds strong growth potential for its continued advances in economic complexity, with Georgia, Lithuania, Belarus, Armenia, Latvia, Bosnia and Herzegovina, Romania, and Albania all ranking in the projected top 15 economies on a per capita basis. Outside these growth poles, the projections also show potential for Egypt to achieve more rapid growth. Other developing regions face more challenging growth prospects by making fewer gains in their economic complexity, including Latin America and the Caribbean and West Africa.

“Countries that have diversified their production into more complex sectors, like Vietnam and China, are those that will lead global growth in the coming decade,” said Ricardo Hausmann, director of the Growth Lab, professor at the Harvard Kennedy School (HKS), and the leading researcher of The Atlas of Economic Complexity. “China and Vietnam already realized many of the income gains from their increased complexity. Nevertheless, they remain more complex than expected for their income level so will remain global growth poles.”